Seller Beware – of biggest shake-up to property law in 50 years

Architect of Queensland’s new seller disclosure laws says the reforms could boost trade for conveyancers.

A looming overhaul of Queensland property laws that includes sweeping new rules on seller disclosure could boost trade for the state’s conveyancers and property lawyers.

That’s according to Sharon Christensen, the head of QUT’s School of Law, engaged by the state government to review Queensland property laws ahead of the revamp.

Christensen says the new seller disclosure laws, set to take effect in August, will add less than a day to workloads of real estate agents in the state, but may still result in many of them passing on the task to conveyancers.

“I’ve heard varying reports about whether some real estate agents saying they’re still going to do the disclosure, others are saying we’re just going to get the seller’s lawyer to do that for us,” Christensen tells Australian Conveyancer.

“Conveyancers would be well equipped to do this type of work – for experienced conveyancers the prospect of doing this won’t be significantly different to NSW or Victoria.”

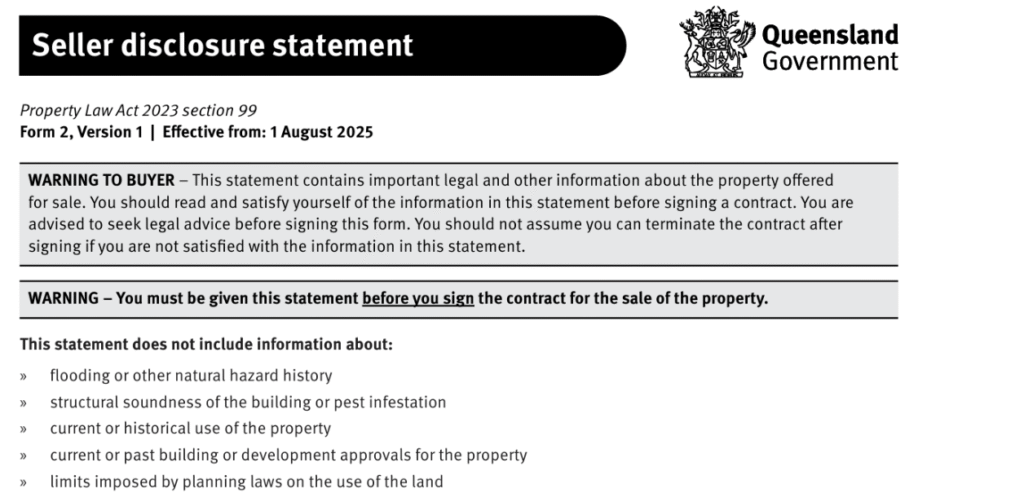

Under the new rules, which bring Queensland into line with the rest of the country, a property vendor must provide to a buyer a “seller disclosure statement” and prescribed certificates like a title search copy of the plan of survey prior to signing a sale contract.

A failure to comply may allow a buyer to terminate the contract prior to settlement.

Real estate agents that offload the seller disclosure work will likely be those scrambling to get up to speed with the new obligations, according to Christensen.

“It depends on what approach as a conveyancer or a lawyer you were taking in terms of a seller transaction before,” she says, referring to the impost on real estate agents.

“Ideally if a client came to you and said I’m selling my property, you would have engaged in all of these enquiries and searches up front.”

However, with the “average real estate agent” it’s often the case that “they might have done a title search but they wouldn’t have looked at a registered plan of the property”.

“It’ll be interesting to see where the practice lands in terms of who does it.”

Christensen concedes that the reforms – the first major overhaul of state property laws in five decades – have met some industry resistance, but says they were urgently needed.

After such a long time on the books seller disclosure needed updating.

She says took place after examining others state to ensure the new rules were “the essential information that a buyer needs to make a decision about the value of the property”.

In crafting the changes, there was focus on several key principles.

Christensen highlights clarifying disclosure obligations of sellers, introducing a transparent and effective form of disclosure, providing information of value to the decision of a buyer to purchase, and balancing the information cost between buyer and seller.

While it sounds like a lot of change, the academic says the practical impact will be minimal.

“Except for a few things where you actually have to attach an official document like a title search and a plan or a community management statement, a property owner who’s paying attention to what’s happening with their property would know all the other information that’s relevant to be disclosed,” Christensen says.

“We tried to make sure the information is streamlined in terms of what we’re handing to buyers.”

On this point, the law academic says decisions were made not to include building reports as a mandatory disclosure, and to add a basic flood warning into the document.

“There was some keenness to say you’ve got to have a flood report but all of these things are at local government level,” she says, highlighting different capabilities between city and country councils.

Some local government areas like the Brisbane City Council have free searching on flood risk but that’s not the case right across the state.

“You can actually go on and look at Brisbane City Council’s interactive flood maps and get a report but when you go out to some of the regional councils, they don’t have that level of information so it was a bit hard making a law for the whole of Queensland.”

Irrespective of location, when it comes to assessing flood risk, Christensen urges buyers to look at the state government’s online flood map as well as using local council tools.

Of the new flood warning, she says ‘it’s bringing that to the front of mind of buyers’.

For those wary of the impending changes, Christensen emphasises that they mostly represent a shift in when information is disclosed to buyers.

“From the perspective of creating the legislation and drafting the legislation, the government did do a lot of consultation to make sure they have the wording right to make sure there weren’t any unforeseen practical issues that arose,” she says.

“It’s bringing forward the information to the negotiation stage rather than allowing a buyer to sign up, search later, and then potentially pull out of the contract if they find something.”