Cash rate calls having less impact on property market

Reserve Bank rate calls are no longer having as much of an impact on buoyant property market, according to conveyancers.

RESERVE Bank cash rate calls are not having a fundamental impact on conveyancers’ workloads.

That’s the view of several practitioners who spoke to Australian Conveyancer after the RBA chose to hold rates at 3.85 per cent – confounding markets and disappointing millions of mortgage holders.

Prospective buyers are keeping conveyancers at full pelt through the usually quiet months of July and August.

And the feedback they are getting from those moving home is that global uncertainty is an important factor – whether it’s driving them towards bricks and mortar or making them more cautious.

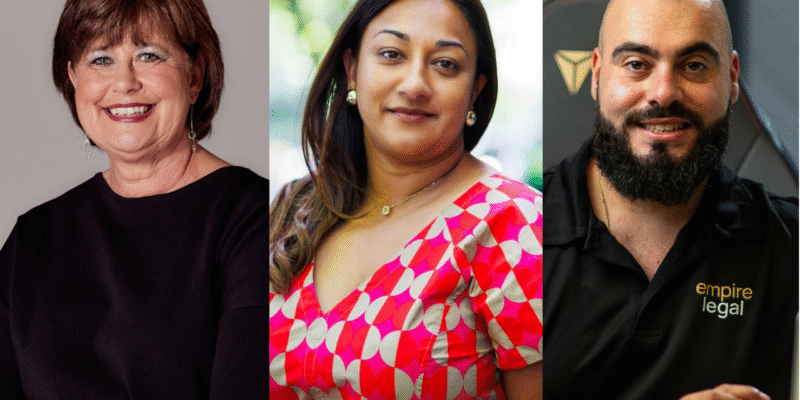

Former SA Australian Institute of Conveyancers President Denise McKay said: “Rate calls are not having as much of an impact as they used to.

“Since COVID – when we thought the market would plummet, but it didn’t – we’ve been much more consistent in how busy we are.

“With all the global uncertainty, people are saying ‘stuff it’, we have to keep going.

“We keep thinking it’s going to get quieter next month and then we get in to a load of files we need to process. Everyone is telling us they’re flat out.”

For AIC VIC President Shakila Maclean, the news that inflation is heading in the right direction is welcome but global volatility is leading to a more circumspect property market.

“For the conveyancing sector, this uncertainty means buyers are more cautious,” she said.

“At the same time, Melbourne’s market is heating up with more interstate buyers.

“With other states becoming less affordable, Victoria is looking like better value, pushing up demand and, in some cases, speeding up settlement timeframes.

“For conveyancers, this brings both opportunity and pressure.

“Many buyers are purchasing from afar, navigating unfamiliar legal rules, or needing more tailored support. Clear advice, quick turnarounds, and local knowledge are more essential than ever.”

Empire Legal director George Sourris is also of the view that the rates hold will not lead to a setback, adding that buyer confidence is fuelling an ongoing boom.

“Despite the hold, I truly believe the Queensland property market will continue to go from strength to strength,” he said.

“Increased buyer confidence will inevitably continue.

“We are already seeing the trend of limited supply and a lack of development approvals continuing – meaning high pricing and demand for property in Queensland will continue.

“Traditionally, Queensland property begins to accelerate at this time of year, with “spring selling season” approaching.

“Last year, we saw a 48 per cent increase in YOY conveyancing matters compared to the July before.”

“If history repeats itself, coupled with the forecasted future interest rate drops for 2025 upcoming, conveyancers across the state should be preparing for a busy season.”