Conveyancers put on notice by AUSTRAC

The financial crimes regulator will not hesitate in pursuing businesses who breach tough new anti-money laundering rules.

AUSTRALIA’S financial crime regulator has sounded a warning to the nation’s conveyancing industry to comply with tough new anti-money laundering laws, saying it will not hesitate to pursue businesses that breach the rules, legislated last month.

The “tranche 2” reforms expand the country’s anti-money laundering and counter terrorism financing (AML/CTF) system to “high-risk services” provided by real estate professionals such as conveyancers. They also catch for the first-time lawyers, accountants, trust and company service providers, and dealers in precious metals and stones.

Initially proposed 16 years ago, the reforms, to take effect from mid 2026, bring Australia into line with standards adopted around 200 jurisdictions globally. China, Haiti, Madagascar, and the United States are among a handful of other nations without tranche 2 laws.

Among key requirements are that conveyancers must understand the source of their client’s wealth and to report suspicious financial matters to the regulator.

Regulator eyes enforcement

Australian Transaction Reports and Analysis Centre (AUSTRAC) said it would “collaborate and support reporting entities to meet their obligations in the first instance”, but indicated a tough approach to conveyancers that paid insignificant attention to the new regime.

“AUSTRAC understands that the majority of tranche 2 entities intend to comply and will support them to do so. However, AUSTRAC will not hesitate to take enforcement action where reporting entities do not take their compliance obligations seriously,” an AUSTRAC spokesperson told Australian Conveyancer.

“Law enforcement has identified some service providers being unwitting facilitators or reckless to the risk of money laundering, which has allowed their skills to be exploited by criminals.”

AUSTRAC was “partnering with industry to ensure that all reporting entities are aware of and understand their obligations and provide sufficient time and practical guidance to implement them,” the spokesperson added.

The agency has said the reforms are needed to curb up to $60.1 billion in harm in Australia from drug trafficking, cybercrime, scams, child exploitation and human trafficking.

Entities to be regulated from 2026, like conveyancers, will need to enrol with AUSTRAC with AUSTRAC from March 31, 2026, with some other obligations commencing in July.

Crackdown on real estate

Real Estate Institute of NSW chief executive Tim McKibbin said AUSTRAC would have the property market in its sights as soon as the new regime took effect.

“It is going to be a focus and it should be,” McKibbin said, adding that available research showed significant washing of illicit money through real estate in Australia.

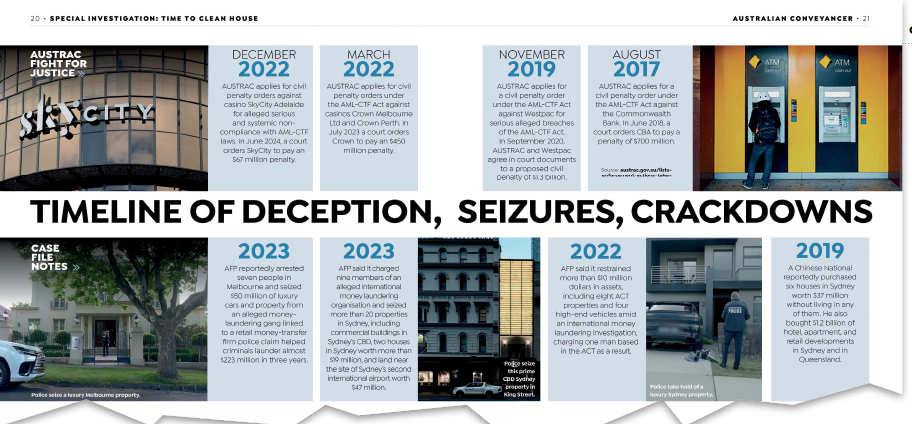

Of the $1.1 billion of criminal assets Australian Federal Police seized between 2019 and 2024, more than $720 million involved real estate. More than 370 residential and commercial properties were seized over the same period.

A lack of regulation has led to Australia’s property sector becoming an easy target for criminals looking to launder money, according to experts.

“We all understand that we have to do this, as a country we have to do it,” McKibbin said.

He said a big issue as enforcement loomed was ensuring conveyancers could comply in a way that imposes a light cost and administrative burden.

It would be a “tragedy” if AML/CTF changes forced businesses to close, he said.

“We need to find ways forward that enable people to discharge their obligations without putting them to the point that they can’t afford it,” he said.

“We’re trying to build an environment within which we can give the regulator what they want and empower the industry to deliver a compliant outcome at the minimal cost.”

AUSTRAC said it was working to minimise costs to small business from tranche 2, including by developing “AML/CTF Program kits” that will provide “a fully developed AML/CTF Program for a low complexity small business” such as a conveyancing firm.

“The AML/CTF Program kits are currently being developed in partnership with industry through dedicated Working Groups,” AUSTRAC’s spokesperson said.

Conveyancers urged to prepare

Bright Corporate Law principal David Jacobson said there was no reason for conveyancers to panic about AUSTRAC enforcement given they have more than a year to prepare.

However, he said industry players needed to take sufficient time in 2025 to get compliant.

“What’s going to be new is that they’ll have to register with AUSTRAC if they’re doing real estate conveyancing, they’ll need a compliance program, and they’ll need policies and procedures to make sure they comply,” Jacobson said.

“It’s an extension of what they already do, but it does require to have some policies and procedures in place to check on clients and to report if they see anything suspicious.”

He suspected AUSTRAC would be looking closely at high value real estate transactions in notorious hotspots like Queensland’s Gold Coast.

In addition to residential real estate, AUSTRAC could also be closely looking at commercial and rural land deals, as well as purchases from particular countries or tax havens, he said.

“They might be looking at whether they’re paying in cash,” Jacobson added. “If they’re paying one million dollars in cash rather than getting 95 per cent bank finance for instance, there will be all sorts of things that will raise red flags.”

He added that “AUSTRAC already knows what it’s looking for, and it’s looking for information about where these criminal proceeds are going to. They’ll be looking for information from conveyancers about that.”

It was likely AUSTRAC would use “transition period” once the new laws kicked off to be lenient on non-compliant businesses. But this was unlikely to last long.

“There’ll be a transition period, but AUSTRAC will be focusing on whether or not conveyancers have actually registered with them, that’s the first thing, and then they’ll be looking at what reports they’re receiving,” said the Queensland-based lawyer, whose firm specialises in legal advice for financial services providers.

“Seeing as AUSTRAC has already targeted real estate transactions as a potential money laundering haven, I suspect they will be looking at the quality of information they get initially and asking some question before they start to do anything serious,” he added.

Look out for red flags

With real estate professionals likely key targets for AUSTRAC, Ches Rafferty, CEO of digital verification tech company Scantek, urged quick action on tranche 2 compliance.

A key point to remember, he said, was that “the regime has been successfully introduced across many sectors for well over a decade now in Australia and it’s really business as usual for those sectors”.

“So it’s important to realise you do need to get ready to comply, but you don’t need to panic that this is going to be an overwhelming obligation on your business,” Rafferty said.

In terms of minimising exposure to AUSTRAC enforcement, the digital security expert advised conveyancers to have a good look at their client lists for red flags.

Such flags included anyone on AML/CTF checklists as well as those classified as politically exposed persons such as certain foreign government officials, ministers or judges.

On this front, he said it was about conveyancers embedding the ability in their businesses to ask the right questions about potential illicit activity by high profile clients.

“Quite legally, now, a real estate agent for example could be engaging with someone who’s a known money launderer. In the future that’s going to require a lot more due diligence.”

Another consideration when it came to enforcement was that AUSTRAC would likely put a focus on capital city markets, especially their premium segments.

Strong action in the area was little surprise, Rafferty said, given the large amount of money that criminals had poured into Australia’s real estate market in the past decade.

“A lot of money laundering has gone into property in recent years, he said.

“Australia has been seen as a soft target because most modern countries passed tranche two laws five or 10 years ago. Australia is a wealthy nation, good rule of law, high property values, so you can imagine that money launders would see this as a desirable place”.

AUSTRAC resources queried

Shelley Nave, the head of law firm Hunt & Hunt’s banking and finance team, noted that the number of entities forced to report to AUSTRAC would lift from 20,000 at present to more than 100,000 under tranche 2, putting pressure on agency resources.

In May, the federal government said it would $166.4 million to implement the reforms, which it claimed were critical in supporting law enforcement partners in their fight against transnational, serious and organised crime and protecting Australians.

“There’s going to be a huge amount of information coming and so AUSTRAC really needs to prioritise where it’s looking at in terms of its own internal resourcing, it needs to be ready for this,” Nave said.

Nave, echoing McKibbin, described real estate as a high-risk area and a target for money launderers. She said it “will be a priority” for AUSTRAC once the agency could act.

“I think that real estate is a big-ticket issue and in that regard, we do lag behind global standards,” Nave added.

She was sceptical about enforcement being brought forward, in line with a recent senate inquiry recommendation, saying AUSTRAC could only use its “auditing powers” once the laws took effect in 2026.

She labelled the new regime as a “good thing”, saying “money laundering and terrorism financing is not a victimless crime and so it’s positive that this has come”.

“This is going to be a pain point for the implementation stage, but the key is to get education.”

In July, Australian Conveyancer featured real estate’s inviting open door to money launderers in a 14-page special report.