High housing sales are circling Sydney’s West

And how the Victorian and Queensland suburbs shaped up during September as the Spring selling season took hold.

NSW

THE region of greater Sydney area bound by Campbelltown, Liverpool, Marsden Park, Westmead, Marayong and Kellyville has become something of a golden circle of residential property investment, according to the September sales statistics.

The south-west, west, and north-western suburban corridor has become the place where Sydneysiders are buying and settling.

Topping the charts again last month was 2024’s perennial favourite, Marsden Park which continued its growth spurt.

Its proximity to development infrastructure, transport and entertainment, and its comparative “bang for buck”, has made it a destination for families wanting to enter the Sydney housing market and enjoy the lifestyle.

Meanwhile, Ravensdale and Bateua Bay on the state’s Central Coast, attracted enough buyers in September to put those suburbs high on the sales list.

In other interesting insights from the “premier state”:

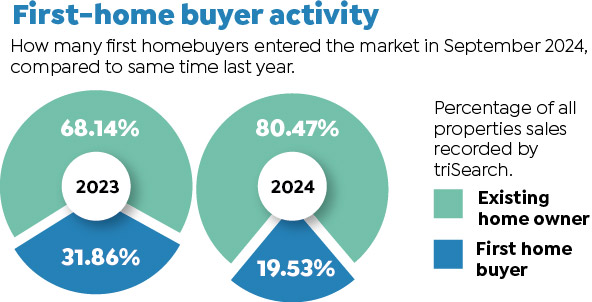

· First homebuyer activity remains lower compared to the previous year, with 19.53 per cent of buyers in September 2024 being first homebuyers, compared to 31.86 per cent in September 2023. This indicates a continued trend of existing homeowners dominating the market.

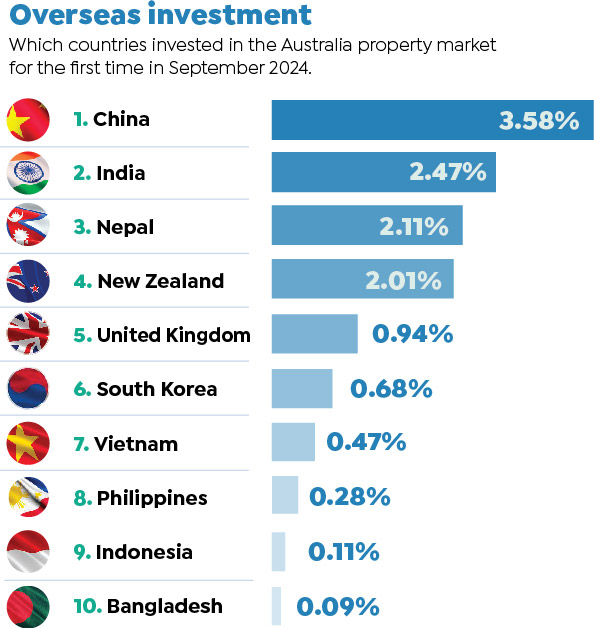

· Overseas investment continues to be led by China and India, followed closely by Nepal and New Zealand, showing a growing interest from South Asian countries.

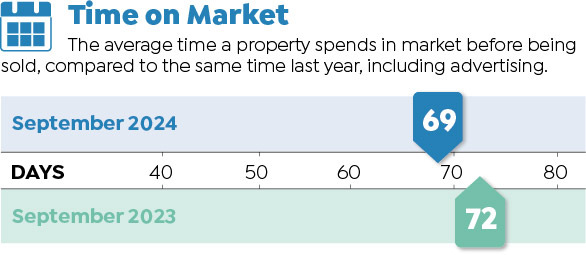

· Illustrating high demand, the average time on market for properties has decreased since last year, with homes spending an average of 69 days on the market in September 2024, down from 72.16 days in the same month in 2023.

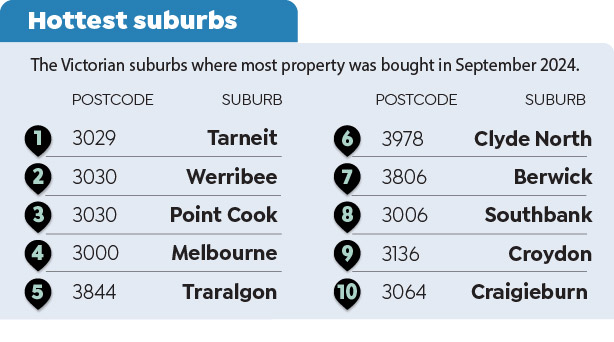

VICTORIA

For residential housing sales in Victoria last month, it was a case of Groundhog Day. Same story line, and the same stars in property terms: The band of spacious suburbs circling the southern capital once again topped the sales chart in September.

Tarneit, Werribee, Croydon, Craigieburn, Berwick, Clyde North, and Point Cook are all between 16 and 40 kilometres out from Melbourne’s CBD, and all of these suburbs are in the 10 Ten of home sales.

It’s a long-standing pattern. A real estate reality.

But the “Groundhog” comparison to the 1990s fantasty romantic comedy about being trapped in a time loop ends with the cute headline.

These sales-leading suburbs are genuinely attractive to buyers because they offer space, security and an easy lifestyle. And they are within a tenable community distance to the centre of town.

Tarneit retains the top spot as the hottest suburb in September; Werribee held steady in second place, while Point Cook climbs to third.

But not everyone is seeking a life outside the “big smoke”. Melbourne city, which is entertainment amenities held down a creditable fourth spot on the property ladder.

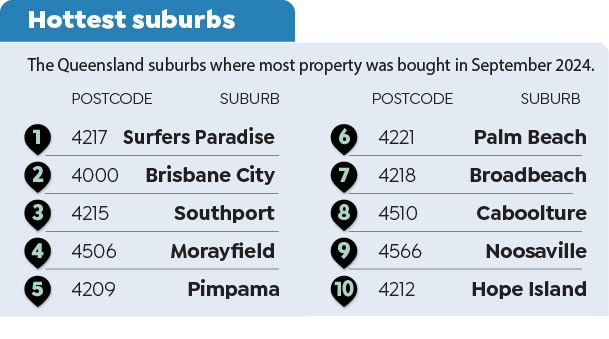

QUEENSLAND

The Bureau of Meteorology tells us that the summer on Queensland’s Gold Coast will be nothing short of spectacular. Expect temperatures to hover around mid-to-high 20s and around 27 dry days in November and 26 days without rain in December.

Ideal living perhaps?

One would suggest the climate and the amenity makes Surfers Paradise, Australia’s playground, the most desired place to settle for home buyers and investors.

The sandy suburb topped the residential sales list in September. And its neighbours, Broadbeach, Palm Beach and Southport were not far behind, ranked 3, 6 and 7 respectively.

The Sunshine Coast region up the road a bit, recorded good sales at Caboolture (8) and Noosaville (9).

The southeast corner is clearly having its time in the sun right now.

But that is not to say that land-loving spots like central Brisbane, with its cool city vibe, has lost its lustre.

Buyers love convenience and proximity to events and work.

They are also savvy to bargains, which is why Morayfield which its value for money, space and security remains near the top of the leaderboard.

First-home buyer activity

Time on market

Overseas investment