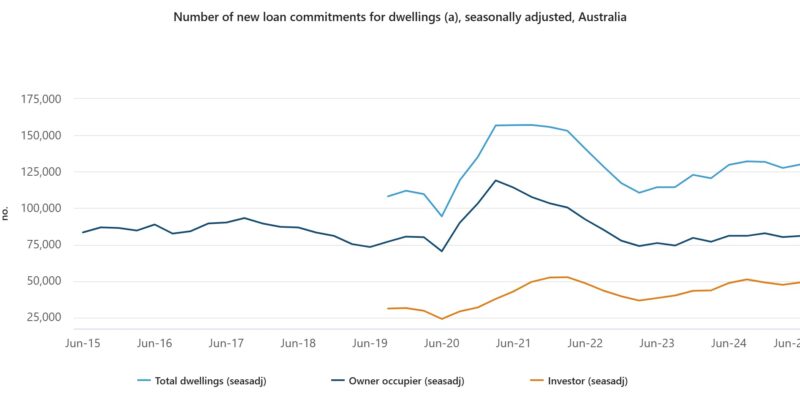

Investors return to the property market, new lending figures show

The 3.5 per cent quarterly growth in the number of investment loans follows two consecutive falls.

LOANS to investors rose by 3.5 per cent in the June quarter while new owner occupier loans rose by 0.9 per cent, according to Australian Bureau of Statistics (ABS) data.

Dr Mish Tan, ABS head of finance statistics, said: “June quarter’s overall rise in home loans followed a fall in the March quarter. Through the year growth was more subdued at around 0.2 per cent.

“That said, lending activity is still at relatively high levels.

“While there were rate cuts in February and May, we will not see the full impact of these on new home lending activity until later in the year.”

There were 49,065 new investment loans approved in the June quarter 2025, a 3.5 per cent rise compared to the previous quarter.

The total value of new investment loans was $32.9 billion, a rise of 1.4 per cent – or $443 million.

“The 3.5 per cent quarterly growth in the number of investment loans follows two consecutive quarterly falls,” Dr Tan said.

“While annual growth slowed to 0.8 per cent from 27.0 per cent in the June quarter 2024, the number of new loans remained historically high.”

In terms of new owner occupier loans approved in the June quarter 2025, the figure was 80,9290 was a 0.9 per cent rise compared to the previous quarter.

“While the number of new owner occupier loans in the June quarter was slightly lower than this time last year, the value of loans rose by 7.4 per cent,” Dr Tan said.

“The average loan size has grown by 7.5 per cent since the June quarter 2024. This was consistent with higher property prices.”

The June quarter rise in the number of loans was driven by Queensland where there were 255 loans, followed by South Australia where there were 137 loans, Tasmania (59 loans) and the Northern Territory (57 loans).

The total number of loans refinanced between lenders rose by 0.3 per cent to 65,205 in the June quarter and was 24.1 per cent higher than this time last year.