Apartment sales outperform houses in supply-starved market

Perfect storm of undersupply - with unit completions falling 40 per cent - and a development pipeline skewed in favour of luxury homes a worry for policymakers.

UNITS outperforming houses in supply-starved markets is the stark reality for policy makers who need a building boom in the high-density sector if they are to achieve targets to tackle Australia’s housing crisis.

With the National Accord a year old this month, the prospect of building 1.2 million homes by 2029 looks as far away as it did on launch day judging by comments by a prominent economist.

“Apartment markets are experiencing an unprecedented phenomenon, with units now outperforming houses in the nation’s three strongest markets,” Ray White’s Nerida Conisbee said.

“It is driven by a perfect storm of chronic undersupply and a development pipeline skewed heavily toward luxury projects.”

Perth units are surging ahead with 13.1 per cent annual growth compared to 11.6 per cent for houses. In Adelaide, apartments deliver 9.7 per cent against 8.9 per cent for houses. In Brisbane, units edge past houses with 9.5 per cent growth.

“This outperformance masks a deeper crisis in apartment supply and affordability,” added the firm’s chief economist.

“The fundamental issue is that hardly any apartments are being built, particularly in the affordable or mid-market segments that once provided accessible housing options.

“When new apartment projects do proceed, they’re predominantly luxury developments targeting premium buyers, pushing median unit prices steadily upward.

Vicious cycle

“This creates a vicious cycle: as affordable apartment supply dwindles, competition intensifies for existing stock, driving prices higher and making units outperform houses not through abundance, but through scarcity.”

Both units and houses are experiencing acute supply shortages.

Apartment construction costs and land prices have risen over 75 per cent since 2020.

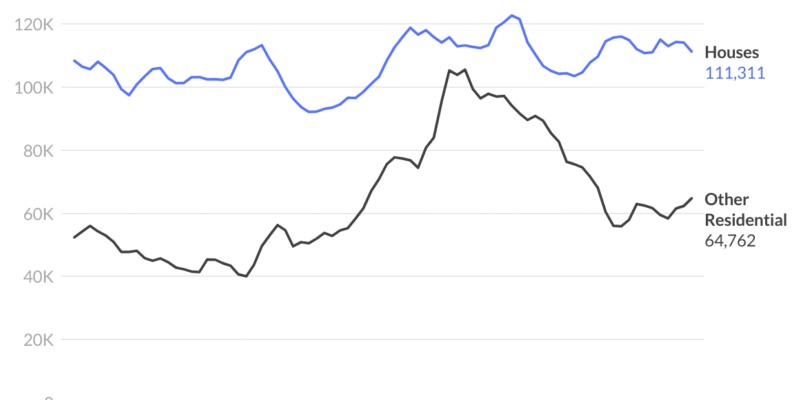

“Australia completed approximately 75,000 apartments in 2024, down from a peak of over 125,000 units in 2016,” she added.

Annual apartment completions have collapsed from over 97,000 in 2018 to just 58,913 in 2023, though 2024 showed a modest recovery to 64,869 units.

That is still 33 per cent below peak levels.

This supply drought explains why units are outperforming houses despite their traditional role as the more affordable option.