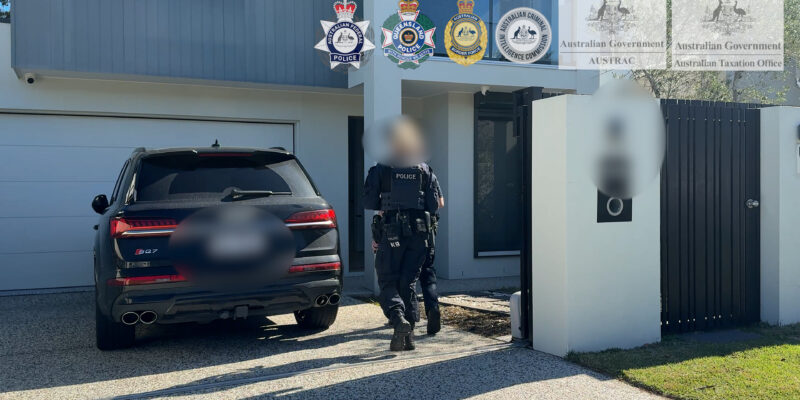

Gold Coast properties worth $10 million seized as part of AML operation

The buildings are part of $21 million worth of assets confiscated by a multi-agency task force that includes AUSTRAC.

SEVENTEEN properties have been seized as part of an operation against money launderers in Queensland.

The buildings are part of $21 million worth of assets confiscated by the AFPs Criminal Assets Confiscation Taskforce.

Four people who have been charged have had their bank accounts frozen – and a fleet of high-priced vehicles have been seized as part of the 18-month multi-agency operation.

More than 70 members from the Queensland Joint Organised Crime Taskforce (QJOCT) – made up of the AFP, Queensland Police Service, Australian Border Force, the Australian Criminal Intelligence Commission, AUSTRAC and Australian Taxation Office – executed 14 search warrants at homes and businesses across Brisbane and the Gold Coast.

AUSTRAC and the ATO also provided analytical expertise and support during the investigation, which was centred on Southeast Queensland but also monitored cash dead drops in multiple cities around Australia.

A Brisbane man, 32, from Heathwood, who was allegedly a major client of the money laundering operation and washed $9.5 million in 15 months, was charged on Thursday (5 June) with money laundering and failing to provide the password to a mobile phone. He has been remanded in custody and is scheduled to face Brisbane Magistrates’ Court today (9 June).

In December 2023, the QJOCTF began investigating suspicious financial transactions. The investigation linked the Heathwood man to a company that had received millions of dollars transferred by suspicious third-party transactions.

Investigators following the money trail allegedly identified the man was a customer of a sophisticated money laundering operation allegedly being run through the armoured transport unit of a security company that transferred $190 million cash into cryptocurrency.

Investigations into the source of the $190 million converted into cryptocurrency by the security company remain ongoing.

A Gold Coast man, 48, and woman, 35, who were the director and general manager respectively of the security business, were each charged on Friday (6 June) with a money laundering offence. The couple, from Maudsland, was granted watchhouse bail and is scheduled to face Southport Magistrates Court on 21 July, 2025.

Another Brisbane man, 58, from West End, who allegedly funnelled laundered money through a business account to a separate business account controlled by the Heathwood man, was also charged on Friday with two money laundering offences. He was granted watchhouse bail and is scheduled to face Brisbane Magistrates Court on 1 August, 2025.

The QJOCTF alleges the Gold Coast-based security company used a complex network of bank accounts, businesses, couriers and cryptocurrency accounts to launder millions of dollars of illicit funds over 18 months.

The security company, which transferred cash between businesses and banks, allegedly mixed cash from its legitimate business arm with illicit funds deposited by suspected criminals.

To further obfuscate the source of the funds from law enforcement, the security company allegedly channelled the money through a web of transactions including through a sales promotion company, a classic car dealership and cryptocurrency exchange services.

The organisation then paid out the funds to beneficiaries using cryptocurrency or those third-party companies.

The Heathwood man allegedly controlled the sales promotion company and received about $9.5 million in cash and cryptocurrency originating from the security company over 15 months.

The QJOCTF will allege the Heathwood man attempted to distance himself from the money laundering scheme by setting his wife up as a “straw director” of the promotions company, while he maintained effective control.

The QJOCTF alleges the West End man was the director of a classic car dealership that received about $6.4 million from the security company and laundered it through his business over a 17-month period.

The director allegedly opened at least seven bank accounts with different banks to conceal the source of the money as he moved it around. The illicit money was then allegedly mixed with legitimate money from the car dealership before being transferred to the sales promotions business.

It is alleged the security company was also the front for the movement of millions of dollars of illicit cash from other states to Southeast Queensland for laundering.

The cash, which was allegedly generated by organised criminal ventures, was left at dead drop locations around the country and collected by a network of couriers who sent it as domestic cargo on flights to Queensland. It was then collected by the security company’s couriers in Southeast Queensland.

During search warrants last week, investigators seized crypto wallets containing about $170,000 in cryptocurrency, $30,000 cash, encrypted devices, along with business records and documents related to the alleged money laundering scheme.

The four who have been arrested are facing multiple charges – some of which carry a maximum life sentence.

AFP Detective Superintendent Adrian Telfer said: “This plot was elaborate and calculated, and it demonstrates the lengths criminals will go to make money.

“Money laundering investigations are incredibly challenging due to the complex web of deception used by criminals, and this crime cannot be tackled by one agency alone.”