Top End property transactions go digital

The switch to eConveyancing will apply to mortgages to begin with, followed by caveats in January and full transfers in August 2026.

PEXA has launched in the Northern Territory, giving conveyancers in the Top End access to digital property transactions for the first time.

The eConveyancing platform has started the transformation to phase out paper property transactions, turning them into a digital process.

The switch will apply to mortgages to begin with, followed by caveats in January and full transfers in August 2026.

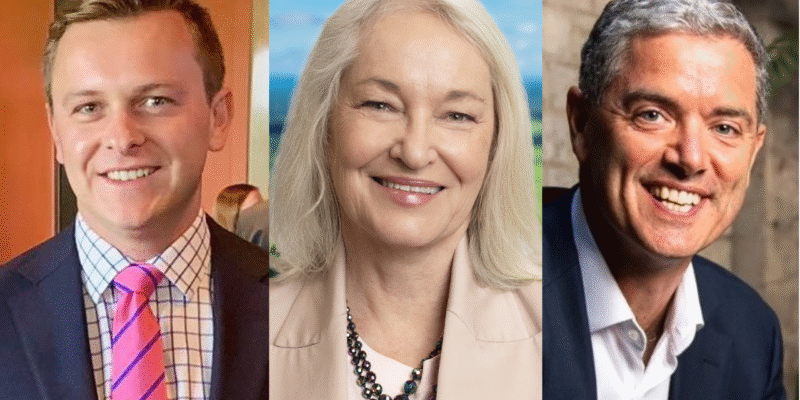

PEXA chief executive Russell Cohen said: “We are thrilled to be able to provide Territorians with access to a more efficient, secure, and reliable property settlement process.

“The PEXA Exchange platform will enable practitioners to conduct settlements and lodgements electronically, removing the need for physical attendance at settlement meetings.

“Territorians can now benefit from equitable access to digital lodgements and settlements, no matter where they live.”

Australian Institute of Conveyancers NT President Sue Carmody welcomed the initiative, declaring it was taking property transfers “out of the dark ages”.

“We still have a long way to go as it only applies to mortgages and refinancing at the moment,” she said.

“We have caveats coming in in January and transfers next August.

“But waiting for transfers to come in does give us the chance to get up to speed. There is still a lot of training we need to do, as none of us are au fait with the program.”

PEXA’s expansion in the Northern Territory now means the platform is available in all states and territories.

It was first adopted by New South Wales in 2013, followed by WA in 2014, Victoria and Queensland in 2015, and South Australia in 2016. ACT adopted eConveyancing in 2019, followed by Tasmania last year.

The platform connects more than 10,000 legal practitioners and 160 financial, government and statutory bodies.

Up to nine parties can be connected in a single transaction.