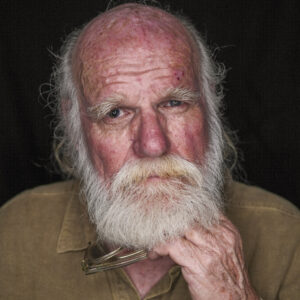

Financial crime expert flags cash transactions as ‘biggest risk’ under new AML-CTF laws

HIGH value cash transactions represent a critical risk conveyancers must assess under Australia’s looming anti-money laundering and counter-terrorism financing (AML/CTF) laws, a leading financial crime risk and compliance expert said. The so-called tranche 2 AML/CTF regime applying to conveyancers, real estate agents, buyers’ agents, developers and lawyers takes effect from July 2026, in what is the biggest regulatory shake-up to hit the nation’s conveyancing industry in decades. Under the revamp, conveyancers will need to register with financial crime regulator AUSTRAC, conduct due dil