Two surveys show rental growth slowing after a four-year surge

Rental growth is starting to ease after four years of runaway rises and prices climbing more than by 40 per cent, according to analysis by both Domain and PropTrack.

RENTAL growth is starting to ease after four years of runaway rises, according to analysis by two leading property data providers.

Both Domain and PropTrack have highlighted the softening rentals market, which is following in the footsteps of the emerging buyers’ market evident at auctions during the Spring selling season.

Despite the slowdown, Domain’s chief of research and economics Dr Nicola Powell said that tenants were still grappling with record asking levels.

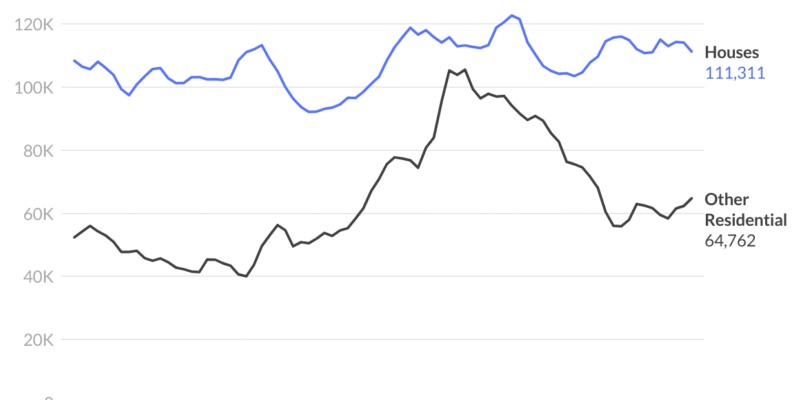

“For the first time in nine months, quarterly rental growth for both houses and units has stalled across the combined capitals, marking the weakest September quarter since 2019 for houses and since 2020 for units,” Dr Powell said.

“This has slowed annual gains to an almost three-year low across the combined capitals, with most cities at multi-year lows.

“Despite the evident slowdown in rental growth, tenants are still grappling with record-high asking rents across all capitals except Brisbane and Canberra, and for units in Hobart.”

That tenants are struggling is not surprising when considering prices have shot up by 40 per cent for units and 48 per cent for houses over the past four years – while wage growth has only managed 13 per cent over the same period.

PropTrack director of economic research Cameron Kusher said he was noticing a significant slowdown on the release of the organisation’s latest snapshot.

“Over the quarter, advertised rents nationally were 1.7% higher and over the year they rose 7%,” he said.

“Although the 7% annual growth was well above inflation, each capital city except for Hobart has seen annual rental growth slow compared to a year ago.

“In fact, the 7% increase in advertised rents is the slowest annual growth since September 2021.”

Both Domain and Proptrack are seeing a return of investors who are trying to get ahead of the RBA’s likely rate cut.

Dr Powell said that the level of investor loans had grown by 35 perf cent over the past year.

“Investors are likely reacting to capital growth potential and seeking to purchase before the RBA lowers the cash rate, which will likely spark housing activity,” Dr Powell explained.

“Currently, investors account for 38% of new home loans, which is well above the decade average.”