Competition freedoms suffer in eConveyancing reform delay

For the past decade, conveyancers have used digital provider, PEXA to settle properties on behalf of home buyers and sellers. PEXA operates as a monopoly. A regulator has been established to promote a competitive environment that drives efficiencies, cost-savings and innovation in the e-settlement space.

THE December 2025 deadline to open up eConveyancing to full competition is at risk after the body leading the reform paused its work and called for federal intervention.

Governments have been pushing to deliver greater competition in digital settlements, breaking the monopoly of Commonwealth Bank-backed PEXA, which in 2023 completed transactions with a property settlement value of over $814 billion.

However, efforts have been delayed, with the Australian Registrars National Electronic Conveyancing Council (ARNECC) pausing the interoperability program, leading the reform.

In a June statement, ARNECC said issues raised by the banking industry are “beyond the remit of state and territories to resolve”.

The council, which has representatives from each state and territory, said it would raise the challenges with the federal government and regulators.

However, the Federal Assistant Minister for Competition Andrew Leigh criticised states and territories for the delays, adding the federal government would only intervene once ARNECC used all its available powers.

Under the reforms, lawyers, conveyancers and bankers involved in an eConveyancing transaction will no longer have to use the same Electronic Lodgment Network Operator (ELNO) for property settlements.

Currently, customers do not have a choice but to use the PEXA monopoly. The second operating ELNO, Sympli – a joint venture between legal software provider Australian Technology Innovators (ATI) and ASX Ltd – was approved in 2019 but cannot yet seamlessly operate within the existing network platform.

A third player, Lextech, does not yet have approval to operate.

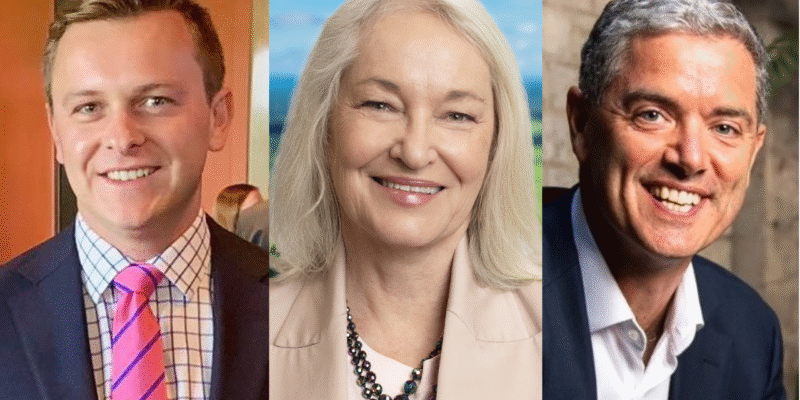

PEXA group advocate Simon Smith said it’s “relieved” the eConveyancing reforms have been paused, given its longstanding concerns with the interoperability model.

PEXA believes the model designed by regulators is flawed because no single party would be accountable if things went wrong.

“The banks have said that the situation – the absence of oversight on financial settlement – is too risky. And we’ve been saying the same thing,” Mr Smith said.

“It’s just proven to be a massive blowout in time and cost because it was never properly designed in the first place.

“There wasn’t a proper business plan and design done, and so it turned into one of those big tech projects that went off the rails.”

However, rival Sympli disagreed, accusing PEXA of promoting falsehoods to undermine the reforms and protect their monopoly.

“What will happen in an interoperable world, is if there’s any issue that happens in a transaction … then a customer goes to the network they subscribe to, to resolve that problem,” Sympli CEO Philip Joyce says.

“Unfortunately, I think (PEXA’s) position has scared stakeholders to such a point that we’re going to have federal or some intervention here to clarify this once and for all.”

While Mr Joyce admitted there were challenges, they did not involve financial services.

“We think the incumbent has executed a pretty sophisticated disinformation campaign here,” he said.

“Most of the issues affecting the execution of this reform are actually not financial settlement issues – they are actually all about the exchange of information between the counterparties, which is in ARNECC’S wheelhouse.

“We’re determined to stick around and get this reform completed.

“This reform is really about choice for conveyancers and that choice and competition is really the benefit for them.”

In a report last week, the NSW Productivity Commission noted PEXA’s “very high profits”, with 88 per cent overall market share in 2023.

The commission also said consumers are unlikely to have fully benefited from lower costs through the shift to eConveyancing, with the estimated $89 million in annual productivity benefits likely flowing to ELNOs via “above normal profits”.

The commission described industry regulator ARNECC as under-resourced and lacking power and has recommended that ARNECC, state governments and the federal government consider making ACCC responsible for overseeing the eConveyancing market.

However, the ACCC has previously turned down the suggestion it should take on a greater role, in light of its other regulatory responsibilities.

While the ACCC said it is aware of ARNECC’s pause in the interoperability program, it “does not have a direct or specific regulatory role in relation to eConveyancing reforms”.

The regulator has “strongly supported efforts to introduce effective competition into the eConveyancing market as soon as is practicable” and noted the “effects of uncertainty and further delay on the development of a competitive market”.

The timeline to achieve interoperability has taken much longer than first proposed, with multiple delays to date.

PEXA’s Simon Smith denied it was deliberately stalling the reforms, saying that making eConveyancing work across different jurisdictions and rules involved great complexity.

“All we’ve been doing is just highlighting the level of detail and matters that need to be resolved if it’s to be done safely,” he said.

The Australian Institute of Conveyancers has previously aired strong concerns about the potential for an ELNO to use its market power to move into the conveyancing market and operate with an unfair competitive advantage.