Minister: Deadlines with penalties needed to keep interoperability on track

The Federal Assistant Minister for Competition wants states to impose deadlines and penalties to ensure the reform of the lucrative electronic conveyancing industry stays on track. The call comes after the interoperability regulator stopped its decade-long work on the change that would dismantle the monopoly help by the publicly-listed PEXA.

THE federal competition minister has urged states and territories to introduce deadlines with penalties to achieve the December 2025 deadline to fully open up eConveyancing to competition.

The call comes as it emerged PEXA – which currently has an effective monopoly – warned the major banks they risked breaching its intellectual property rights if they complied with the regulator’s request for details about certain PEXA functions.

The regulator, Australian Registrars National Electronic Conveyancing Council (ARNECC), has been leading the reform to broaden competition in the eConveyancing sector, in turn dismantling the monopoly of Commonwealth Bank backed PEXA which last year completed transactions with a property settlement value of over $814 billion.

But the reform, known as interoperability, hit a snag in June when ARNECC released a statement saying it was seeking federal intervention after issues raised by the banks were “beyond the remit of state and territories to resolve”.

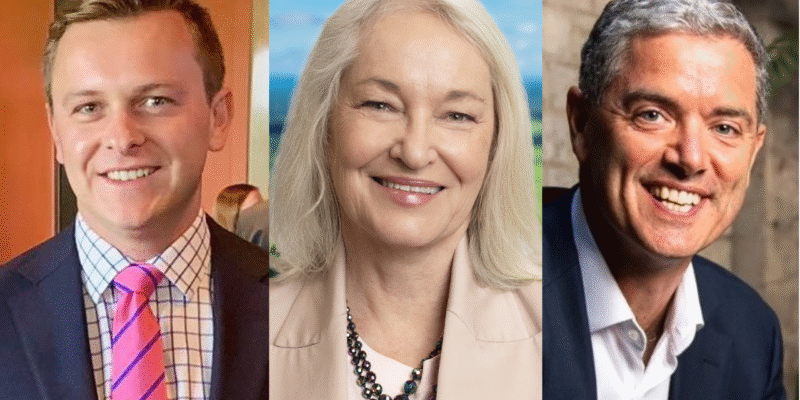

Jenny Cottnam, the chair of ARNECC, which has representatives from each state and territory, declined to be interviewed.

Federal Assistant Minister for Competition Andrew Leigh said he understood that ARNECC “haven’t pressed the pause button,” but “were looking at options” to continue the interoperability program.

“My understanding is that there has been issues raised around financial institutions and how they would engage, and that ARNECC wants those issues worked through,” Dr Leigh said.

The stalemate comes after PEXA sent a letter to the banks following a November meeting between the banks and ARNECC about the interoperability rollout.

In the letter obtained by Australian Conveyancer magazine, PEXA says it is “aware ARNECC requested that the banks provide detailed information about several select PEXA functions”.

“This meeting followed the Ministerial Forum in which the Australian Banking Association (ABA) reflected concerns in the sector that there should be no loss of functionality or features developed by PEXA for the banks in the introduction of interoperability,” the letter reads.

“We appreciate you have and should continue to advise the regulator on the outcomes you are seeking in an interoperable regime and the gaps in functionality of which you are concerned.

“However, PEXA has intellectual property rights over those important functions that we have developed in consultation with our lending institution customers over the past decade.

“It is not reasonable that you are being asked to outline the functionality of those systems to the regulator, especially as this could lead to disclosure of our company’s intellectual property.”

The Australian Banking Association said while the banks support interoperability in principle, they have “ongoing concerns with the current scope and governance of the project, which if unresolved will compromise its success”.

“We have expressed these concerns and continue to seek a government-led resolution,” a spokesman said.

When asked if he knew about the letter, Dr Leigh responded that “various claims have been made” and his focus was on getting PEXA to “do the right thing, which is facilitate interoperability”.

Dr Leigh blamed the predicament on the states’ “ill considered” decision to sell off their interests in PEXA, which is now behaving like “every economics textbook will tell you that’s how you’d expect a monopoly to operate”.

“As a Commonwealth, we’re very happy to play a supporting role where we can if there’s particular issues that fall within the Commonwealth remit,” he said.

“But of course, this goes back to a wrong-headed decision by former state and territory premiers and treasurers to privatise a public monopoly with predictable results.

“States and territories created this problem. States and territories need to step up to solve it in the interest of their citizens.”

Dr Leigh said he has been encouraging state and territory counterparts to consider all available legislative options within their powers, including legislating a timetable with associated penalties to roll out the program.

“Any individual state or territory could legislate a timetable that would benefit its citizens, but also all citizens across the country looking to get a better deal on conveyancing,” he added.

“Those sorts of clear timetables and penalties would create a strong financial interest on the incumbent monopoly to move more speedily.”

Under the interoperability reforms, lawyers, conveyancers, and bankers involved in an eConveyancing transaction will no longer have to use the same Electronic Lodgment Network Operator (ELNO) for property settlements.

Currently, customers do not have a choice but to use the PEXA monopoly. The second operating ELNO, Sympli – a joint venture between legal software provider ATI Global Limited and ASX Ltd – was approved in 2019 but cannot yet seamlessly operate within the existing network platform.

A third player, Lextech, does not yet have approval to operate.

While ARNECC has been “working hard” on dealing with the technical issues associated with opening up the eConveyancing platform to competition, Dr Leigh acknowledged the “significant challenge” they face.

“I note when PEXA was moving into the UK market, it was able to deal with its tech issues very speedily. When it comes to allowing a competitor in the Australian market, it seems to be moving at a much slower pace,” he said.

“As a federal government, we’re very keen to see more competition in the eConveyancing space, very keen to work with states and territories as they look to solve a problem that was created by states and territories.

“Competition brings a couple of things to consumers. First of all, it delivers lower prices, but it also delivers innovation. We know that uncompetitive markets tend to have higher prices, the monopolies get lazy and they don’t deliver for consumers in the same way.

“Any way in which we can help Australian homebuyers save money is something which ought to be a high priority for all policymakers.”